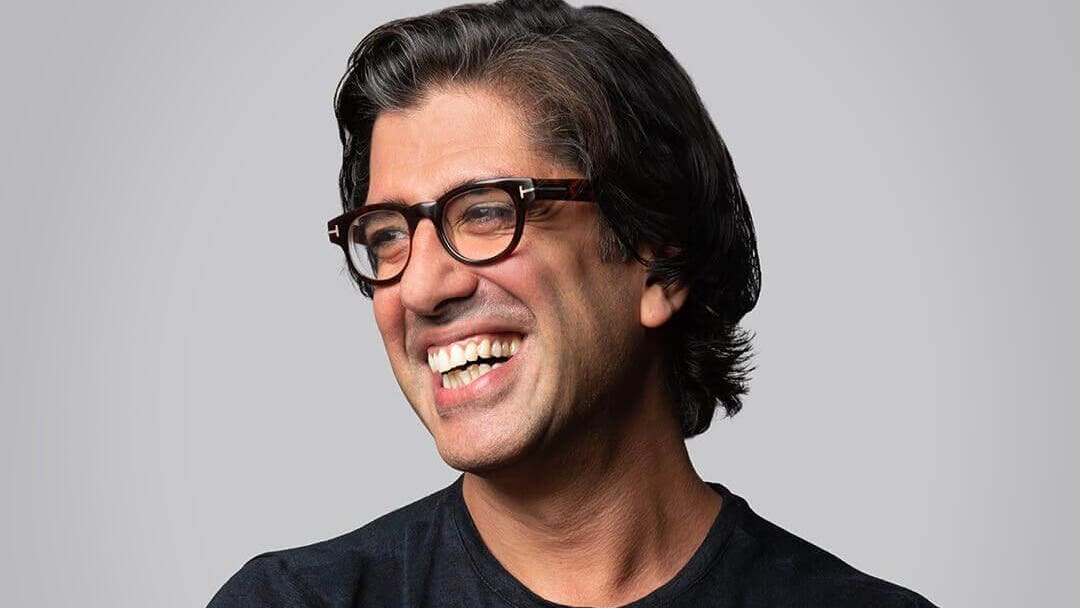

ORA founder and CEO Elias Pour

Is the future of healthcare digital? Elias Pour, the founder of Singapore-based tele-health platform ORA, thinks it will be – but also believes the winners in this market will offer more than simply a digital experience. ORA, which is today announcing a $10 million Series A financing round, is a vertically-integrated platform built on the basis of that view.

Pour is a former chief marketing officer at the South-East Asian e-commerce giant Zalora, where he spotted an accelerating trend well before the Covid-19 pandemic focused more attention on digital health. “We saw a younger generation of consumers in the South-East Asia region really taking much more interest in looking after themselves,” he recalls. “They wanted to look good and feel good, and they were devoting more of their disposable income to that.”

Pour’s vision for ORA started there, with the business launching in 2021. It offers healthcare services through three separate brands: Modules is dermatology-focused, offering skincare treatment and advice; andSons is focused on the male health market; and OVA delivers female reproductive healthcare. The brands operate individually but sit on the infrastructure that ORA has built at a group level.

With consultations provided digitally, ORA has grown quickly. It has delivered more than 250,000 consultations since its launch, with customer numbers growing every single month. But importantly, Pour believes vertical integration is the key to building a sustainable long-term business, particularly given factors such as rising pharmacy costs. The business has invested in physical clinics through which it can also offer care, it owns its own pharmacy operations, and it is also developing its own ranges of treatments and products. Its brands should be available within 1,300 stores later this year.

The direct-to-consumer model works especially well in South-East Asia, Pour says, where around 40% of healthcare spending is paid for by individuals themselves. Build in demographic factors, including the rapid growth of the affluent middle-class population in several countries across the region, and concern about fast-rising healthcare costs, and there is scope for a vertically-integrated challenger brand to have a huge impact.

It also helps that the areas in which ORA has chosen to focus on are those where people need help with chronic conditions rather than one-off treatments. Around 70% of the company’s revenues are recurring – largely through subscription plans – and ORA boasts better retention rates than Netflix, Pour says.

Building those relationships with younger people, who want support with non-life threatening conditions that nevertheless undermine their confidence and happiness, is crucial, the company believes. “Our whole thesis is that if we can build those relationships of trust today, we can also help our patients with other conditions later in life,” Pour adds.

Indeed, expanding into new treatment areas would be an obvious strategy for growth, with ORA already looking closely at areas such as weight management. The company is also eyeing geographical expansion. The Middle East, where consumers also pay for significant chunks of healthcare costs out of their own pockets, is one possibility under consideration – ORA is specifically focusing on the Gulf Cooperation Council (GCC) countries as likely target markets.

Hence the need for investment. Today’s Series A announcement takes the total funds raised by the company to more than $17 million, with the round led by TNB Aura and Antler, and participation from Gobi Partners, Kairous Capital and GMA Ventures.

Charles Wong, a Founding Partner at TNB Aura, believes the company can continue to grow quickly. “ORA’s combined focus on specialised and often taboo healthcare verticals, as well as a direct-to-patient approach, has led the team to clearly differentiate itself,” he argues.

Teddy Himler, Global Partner at Antler, adds: “There are more than 1 billion people in South-East Asia and the GCC who are under-served by the traditional healthcare system, and we think ORA’s platform approach is the future of direct-to-patient healthcare globally.”

Investors in other businesses also think the potential is huge. In Australia, for example, the tele-health business Eucalyptus has just raised more than $30 million of new funding. Hims & Hers, one of the best-known businesses globally in the health and wellbeing sector, recently announced that sales almost doubled last year, to more than $500 million.

“We’re defining a new category in which we combine prescription, over-the-counter and strong consumer products into one proposition with outstanding post treatment service and clinical continuity,” adds ORA’s Pour. “This patient segment is putting healthcare and disease prevention at the top of their concerns and following with their share of wallet.”

The post originally appeared on following source : Source link