Apple Pay simplifies digital transactions, turning your device into a secure payment tool with just a tap. Understanding how does Apple Pay work is essential for small businesses looking to stay ahead in today’s fast-paced market.

This convenient method not only speeds up checkout but also enhances customer satisfaction. Mastering how to accept payments through Apple Pay is crucial for businesses looking to modernize their payment solutions. Continue reading to learn what Apple Pay is and how it works.

What is Apple Pay and How Does it Work?

Apple Pay is more than just a digital payment service; it’s a game-changer for secure and effortless transactions. Whether you’re using an iPhone, iPad, or Apple Watch, this service seamlessly integrates into your daily shopping routine.

Now, let’s explore the magic behind Apple Pay, from in-store tap-to-pay simplicity to the ease of online purchases, and discover how it streamlines payments both at physical locations and on the web. If you have an e-commerce business, then integrating Apple Pay with the new Shopify point-of-sale system can further optimize your business’s payment processing.

Likewise, incorporating Apple Pay into a Squarespace POS can enhance online transaction security. Utilizing the Apple Business Connect tool can further streamline your payment systems and customer interactions. To stay ahead in the digital economy, consider learning to accept crypto payments along with traditional methods like Apple Pay.

Implementing various point-of-sale systems that support different payment methods, including Apple Pay, can significantly boost a business’s versatility and appeal to a broader customer base.

How Does Apple Pay Work In-Store?

Using Apple Pay in-store involves a few simple steps. This method of contactless card payments enhances customer convenience and speeds up transactions. If you’re using an iPhone with Face ID, double-click the side button and authenticate with Face ID or your passcode to open Apple Wallet.

For iPhones with Touch ID, double-click the Home button and use Touch ID to authenticate. After selecting your card, hold your iPhone near the payment terminal until you see “Done” and a checkmark on the display.

For Apple Watch, double-click the side button to open your default card or scroll to select a different one. Then, hold the display of your Apple Watch near the contactless reader until you feel a gentle tap and hear a beep, indicating the payment is complete.

Integrating Apple Pay into your existing point-of-sale systems enhances transaction efficiency and customer experience. For booth rental situations at fairs or markets, Apple Pay offers a swift and secure payment option for customers. Consider also accepting the Samsung digital payment system to cater to a wider range of customers.

How Does Apple Pay Work Online?

Using Apple Pay online is a convenient and secure way to make purchases. When shopping in Safari or within apps, select Apple Pay at checkout as your payment method. Tap the Apple Pay button or choose Apple Pay as the option, and then, if necessary, select a different card by tapping the Next button or the Expand Menu button.

Enter your billing, shipping, and contact information only if required. This system eliminates the need to manually enter your card, shipping, or billing details, streamlining the checkout process. Simply confirm the transaction with your passcode or biometrics to complete the purchase. Additionally, Apple Pay can be used on Macs and iPads for online transactions.

On a Mac, click the “Buy with Apple Pay” button on a website and authenticate with Touch ID on your Mac, or use a compatible iPhone to authenticate the purchase. Along with Apple Pay, incorporating Amazon Pay can offer your customers another familiar and secure online payment option.

For businesses with an Etsy store, enabling Etsy Apple pay simplifies transactions for both sellers and buyers. Additionally, integrating Shopify Apple Pay can enhance the checkout process on your e-commerce site.

Benefits of Using Apple Pay For Your Small Business

| Benefit | Description | Impact on Business | Key Considerations |

|---|---|---|---|

| Enhanced Security | Apple Pay uses advanced security features like tokenization and Touch ID. | Reduces risk of fraud and increases customer trust. | Inform customers about the security benefits to encourage usage. |

| Fast Transactions | Quick processing of payments. | Speeds up the checkout process and improves customer experience. | Ensure your payment systems are updated for compatibility. |

| Convenience for Customers | Easy and contactless payment option. | Attracts tech-savvy customers and enhances convenience. | Promote Apple Pay as a payment option both in-store and online. |

| Reduced Payment Processing Fees | Competitive processing fees compared to traditional credit cards. | Lowers transaction costs for the business. | Analyze cost savings against current payment processing fees. |

| Customer Loyalty | Integration with loyalty programs and digital wallets. | Encourages repeat business and customer loyalty. | Implement loyalty programs that are compatible with Apple Pay. |

| Wide Acceptance | Growing acceptance of Apple Pay globally. | Attracts a wider customer base, including international customers. | Ideal for businesses with a diverse customer base or tourist traffic. |

| Contactless Safety | Minimizes physical contact at points of sale. | Addresses health and safety concerns, especially post-pandemic. | Highlight contactless nature in marketing materials for health-conscious customers. |

| No Additional Hardware | Works with existing NFC-enabled POS systems. | No need for additional investment in hardware. | Check compatibility with your current POS system. |

| Reduced Cash Handling | Less reliance on cash transactions. | Lowers the risks and costs associated with cash handling. | Encourage cashless transactions for efficiency and safety. |

| Marketing Appeal | Associated with a tech-forward, modern brand image. | Enhances the brand’s appeal to modern and tech-savvy consumers. | Leverage Apple Pay as part of your business’s tech-friendly image. |

How Does Apple Pay Work on iPhone?

Apple Pay on the iPhone offers a seamless and secure way to make payments. It’s simpler than using a physical card and enhances safety. With your cards stored in the Wallet app, you can make payments in stores, for transit, in apps, and on websites that support Apple Pay. This feature varies by country and region, adding to its versatility and global appeal.

In the context of mobile payments, it’s also worth exploring the Apple Pay cash feature, which offers an alternative way for businesses to handle transactions.

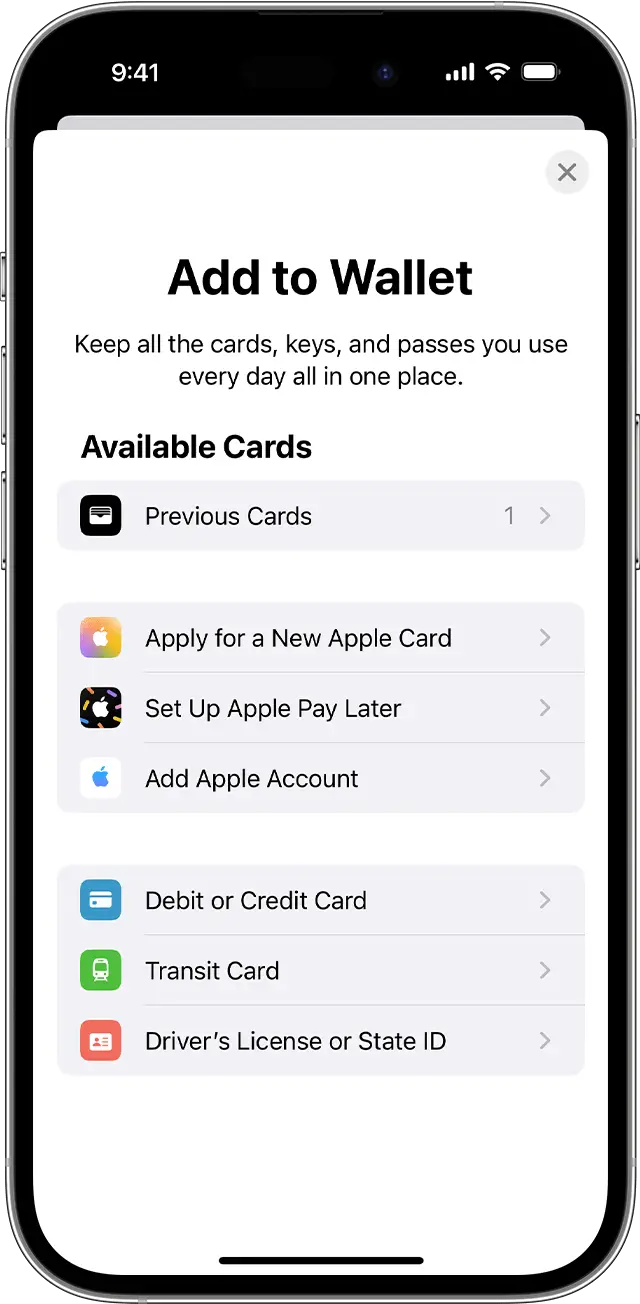

Setting up Apple Pay on iPhone

- Open the Settings app on your iPhone.

- Tap Wallet & Apple Pay.

- Select Debit or Credit Card.

- Tap Continue.

- Scan the card associated with your Apple ID or tap Add a Different Card.

- If you select Add a Different Card, position it within the frame on your device to read the card details.

- Alternatively, choose Enter Card Details Manually.

- Enter your card’s Expiration Date and Security Code, then tap Next.

- Tap Agree to the terms and conditions.

- Choose a verification method for your card: Email, Text Message, or Call. Tap Next.

- Enter the verification code received.

- Success! Your card is now in the Wallet app and ready for use with Apple Pay on your iPhone.

Alternatively, you can set up Apple Pay directly in the Wallet app. Open the app, tap the + button, and follow similar steps to add your card. You can enter card details manually or use your device’s camera to capture the card information. After entering the security code and verifying your card through your bank, the card will appear in the Wallet app.

How do I use Apple Pay on my iPad?

Using Apple Pay on your iPad allows for secure and convenient payments in apps and on websites that support Apple Pay. This feature is particularly useful for online shopping and in-app purchases, providing a seamless payment experience without the need to enter card details manually. Remember, the availability of Apple Pay and its features varies by country or region.

Setting Up Apple Pay on iPad

- Go to Settings, then select Wallet & Apple Pay on your iPad.

- Tap Add Card. You might need to sign in with your Apple ID.

- You have a few options:

- Add a new card: Tap Debit or Credit Card, tap Continue, then position your card in the frame or enter details manually.

- Add previous cards: Choose any cards you’ve previously used, including those associated with your Apple ID, used on other devices, or added to Safari AutoFill. Authenticate with Face ID or Touch ID and follow the instructions.

- Add a card from a supported app: Tap the app of your bank or card issuer.

- Your card issuer will verify if your card is eligible for Apple Pay and may ask for additional information to complete the verification process.

- Alternatively, open the Wallet app on your iPad, tap the + button in the top-right corner, and press Next.

- Enter your credit/debit card information by scanning it with your device’s camera or manually entering the details. Then tap Next.

- Enter your card’s security code and expiration date. Tap Next, agree to the terms and conditions, and press Agree again.

- Select your preferred verification method and input the verification code provided by your card issuer, which can be sent via call, email, or text.

- Finally, tap Next and Done. Your card will then be activated and ready to use with Apple Pay.

How do I Use Apple Pay with Apple Watch?

Apple Pay on Apple Watch provides a secure and private way to make payments. By storing your cards in the Wallet app on your iPhone and adding them to your Apple Watch, you can make contactless payments in stores, use transit cards, and even send and request money in Messages or using Siri.

This functionality allows for convenient transactions without needing your iPhone present, making it an ideal solution for quick and secure payments. The new Apple Watch further simplifies using Apple Pay with its updated features and enhanced user interface.

How to Set Up Apple Pay on Apple Watch

- Bring your Apple Watch and iPhone close together.

- Open the Apple Watch app on your iPhone.

- Scroll down and tap on “Wallet & Apple Pay.”

- If you use Apple Cash on your iPhone, it will automatically be enabled on your Apple Watch.

- Tap “Add Card” to add a new card or “ADD” next to the card you use on your iPhone to add it to your Apple Watch.

- Follow the on-screen instructions to complete the card addition process.

- Once you finish adding your card, it will be marked as “Card Added” on your iPhone.

- If it’s the first card you’ve added to the Wallet app on your Apple Watch, it becomes the default payment card.

- You can change the default card in the Wallet & Apple Pay settings in the Apple Watch app on your iPhone.

- Your Apple Watch will emit a sound and display a notification when the card is successfully added.

Additionally, you can directly add a card to your Apple Watch:

- Open the Wallet app on your Apple Watch.

- Tap the More Options button, then tap Add Card.

- Choose Apple Account, Debit or Credit Card, or Transit Card; then follow the on-screen instructions.

- The card issuer may require additional verification steps.

Setting up Apple Pay on Apple Watch is straightforward and enhances the convenience of making payments without the need for your physical wallet.

What Credit Cards are Compatible with Apple Pay?

Apple Pay is a widely used payment method, accepted by most major banks and credit unions in the U.S. and over 60 countries globally. It supports major credit, debit, and prepaid cards and is accepted by over 85% of U.S. retailers.

With its expanding network, including major financial institutions in Asia-Pacific, Canada, and Latin America, Apple Pay offers easy transaction options for a vast majority of credit card users.

How Your Small Business Can Use Apple Pay

Mobile wallet usage statistics are growing at an impressive rate across the board. Apple Pay currently has nearly 400 million users around the world, making it one of the most prominent mobile payment options. And there are more than 1.5 billion Apple devices in use.

So, the payment method is likely to grow even more. As a business, the ability to accept Apple Pay may increase your customer base. As more and more consumers stop carrying cash, debit, and credit cards, the places that accept mobile payments will draw in those payments.

Additionally, Apple Pay simplifies the payment process significantly, both in stores and online. This means your customers spend less time fumbling for cards or looking for payment information.

Since these obstacles often lead to people rethinking purchases, especially online, support for Apple Pay may lead to more completed sales. The ease may also save your team time as they collect in-person payments at stores, restaurants, or other businesses.

To start accepting Apple Pay in stores, you need a contactless POS terminal that works with Apple Pay. This generally works with any reader that accepts Discover debit contactless transactions.

But contact your POS provider to find out for sure if your reader can accept Apple Pay. From there, display the Apple Pay logo at your payments terminal and anywhere you provide payment information to let customers know.

To use Apple Pay for online payments, choose an online payment provider that works with Apple Pay. These include popular options like Shopify, Squarespace, WooCommerce, Stripe, and Worldpay, among others. Or you can go to Apple Pay for Developers to configure your own payment system that will support Apple Pay.

Send and Receive Money

Accepting customer payments isn’t the only reason for businesses to use Apple Pay. It can also provide an easy and secure platform for your own transactions. In fact, Apple Pay allows you to send and receive payments easily in the Messages app of your iPhone or other Apple device.

This can be useful if you’re texting with a client or sharing expenses with a colleague on a business trip. Instead of using a third-party payments app or having to withdraw cash, you can simply send and receive money in the apps you already use.

To use this option, you must have Apple Pay set up with a credit or debit card. Then, open your Messages app and start a conversation with the person you want to send money to. Tap the app’s icon next to the text box and then click the Apple Pay logo.

Enter the amount, click the send button, and then confirm your payment using your passcode, face, or touch ID. Users can also send you a request for payment, at which point you just confirm the amount and send the appropriate payment.

Alternatively, if a client or colleague sends you money using Apple Pay in the Messages app, you just need to accept the terms and conditions to receive payment. The money is automatically added to your Apple Cash account. There, you can spend it with Apple Pay, send it in another message, or transfer it to a connected bank account.

Apple Pay is also one of the cheapest ways to send money, reducing transaction costs for businesses. Similarly, the Venmo app can be a useful tool for handling peer-to-peer transactions efficiently. Besides these options, offering ACH payment as a way to pay provides another reliable method for handling business transactions.

Make Contactless Payments

Apple Pay can also simplify the payments you make to vendors or other businesses in your area. Say you need to pick up some supplies for an event you’re hosting. While you’re running errands, you can quickly stop into a store in your area and make a payment with just your iPhone or Apple Watch.

There’s no need to keep credit or debit cards on you at all times. And you can even use your Apple Cash card or account to complete payments with money you’ve recently received from others. This process is very straightforward; you simply hold your iPhone or Apple Watch up to a card reader to use Apple Pay.

However, some countries and regions have imposed limits on how much you can pay at contactless terminals.

Usually, if you exceed these limits, you just need to enter a pin or signature to complete your purchase. In the U.S., you may need to sign for Apple Pay purchases over $50.

In addition to contactless payments being a convenient option for your business purchases, it’s also secure. Face ID, Touch ID, and/or your passcode are needed to complete purchases.

So you can avoid carrying your credit and debit cards around with you, especially on business trips or at events where they may be tough to keep track of. And since Apple Pay allows you to add multiple cards, you can use Apple Pay for both business and personal purchases.

But you don’t need to worry about your contactless purchases getting mixed up. Using Apple Pay aligns with cash handling best practices, minimizing the risks and hassles associated with physical cash.

Check Your Transaction History

Apple Pay also makes it easy to keep track of your transactions. As a business, it’s important to monitor expenses for bookkeeping purposes. Without Apple Pay, most businesses need to go into their credit card and bank statements to find their full transaction history.

This can be especially complicated if you use multiple credit and debit cards, along with other payment methods. Generally, you need to log into each of these accounts separately. And it may be difficult to track which purchases you made with each card or account.

However, Apple Pay allows you to monitor all of your activity in one place. You can add multiple credit and debit cards to your Wallet app to easily check activity in one place. Even if you don’t plan to use them all for mobile payments, adding them to your device can simplify your bookkeeping.

Additionally, Apple Pay can help you quickly identify and act on any fraudulent purchases. Once you add a card to your Apple Pay account, you can set notifications so you’re alerted when that card is used.

Instead of having to monitor all of your accounts and reach out to merchants when you spot something fishy, you can act right away when you notice a purchase you didn’t make. Apple Pay’s features also help businesses fight credit card fraud at point of sale, providing an extra layer of security during transactions.

Benefit from an Apple Rewards Card

Apple Pay works with a huge variety of third-party credit and debit cards from brands like Visa and American Express. But the company also offers its own Apple Cash Card option. You apply for an Apple Card like you would with a regular credit card. But then the information lives on your Apple devices. Benefits include no fees, security features like Face ID and Touch ID, and cash back.

If you use Apple Pay regularly, these rewards may help you avoid the interest and fees that you pay with other credit cards. Additionally, Apple Pay’s security features help to fight credit card fraud at the point of sale. Apple also encourages business users to pay less interest by providing information about paying off their balance. And there are no limits on daily cash back for qualified users. Incorporating these methods into your business credit card tips can lead to more economical and secure transactions.

Apple Pay Alternatives

While Apple Pay is popular, there are several other digital payment options available. Here’s a look at four major alternatives:

Google Pay

Google Pay offers a seamless way to pay in stores, online, and in apps. It works with Android devices and offers enhanced security with encrypted transactions. Google Pay also integrates loyalty programs and promotions, making it a comprehensive payment solution.

Samsung Pay

Samsung Pay stands out with its compatibility with almost all payment terminals, including older magnetic stripe ones. It is available on Samsung devices and provides a secure, tokenized transaction system. Samsung Pay also offers rewards for every transaction, adding extra value for users.

PayPal

PayPal is a widely accepted online payment system that extends to in-store purchases via its mobile app. Known for its secure transactions, PayPal allows users to shop, send, and receive money internationally. It’s a great option for those who prefer an established online payment platform.

Venmo

Venmo, owned by PayPal, is particularly popular among younger users for its social features. It’s primarily used for peer-to-peer transactions but is increasingly accepted by retailers. Venmo combines the ease of sending money with social interaction, making payments more engaging.

Final Words

In conclusion, for small business owners, integrating Apple Pay can be a smart move. It offers a secure, quick, and user-friendly payment option that caters to the modern consumer’s needs. With its advanced security features and widespread acceptance, Apple Pay not only streamlines transactions but also enhances customer trust and satisfaction, positioning businesses at the forefront of digital payment technology. Embracing various payment apps, including Apple Pay, is key to staying competitive in the evolving digital payment landscape.

Is there a limit to Apple Pay?

Yes, there are limits to Apple Pay. For Apple Cash, you can add up to $10,000 per transaction, with a maximum of $10,000 within a 7-day period. The maximum Apple Cash balance is $20,000. For in-store purchases, limits may vary by country and card issuer.

How can you change your default card on Apple Pay?

??To change your default card on Apple Pay, open the Wallet app on your iPhone, touch and hold the payment card you want to set as your default and drag it in front of your other cards. Alternatively, open the Settings app, tap Wallet & Apple Pay, tap Default Card under Transaction Defaults, and select the card you want to use for Apple Pay purchases.

How many cards can I add to Apple Pay?

On Apple Pay, you can add a maximum of 16 cards. This applies to users who are operating on iOS 15 version 3 or above.

Where is Apple Pay available?

Apple Pay is available in numerous countries across the globe. This includes regions in Africa, Asia-Pacific, Europe, Latin America, the Caribbean, the Middle East, and North America. Some of these countries include the United States, Canada, the United Kingdom, Australia, China, Japan, South Korea, Singapore, France, Germany, Italy, Spain, Brazil, Argentina, Mexico, Saudi Arabia, and the United Arab Emirates, among others. However, the availability of Apple Pay can vary, and it’s recommended to check with local banks and card issuers for specific details.

What are the disadvantages of Apple Pay?

Apple Pay’s downsides include limited acceptance by small businesses, reliance on device battery life, potential technical glitches, and security vulnerabilities. It’s also not available globally, impacting international travel.

How do you use Apple Pay for the first time?

To use Apple Pay for the first time, open the Wallet app on your iPhone, tap the “+” sign, and add a credit or debit card. Follow the on-screen instructions to verify your card with your bank or card issuer. Once verified, you can use Apple Pay at participating stores, online, and in apps.

Is Apple Pay safer than a credit card?

Apple Pay enhances security through device-based features, not storing card numbers, and using tokenization for each transaction. Its safety also relies on user practices like secure passcodes and biometric IDs.

Does Apple Pay work with US federal payment cards too?

Yes, Apple Pay does work with US federal payment cards. This includes cards like those for Social Security and veterans benefits, which are paid through debit cards. The system is compatible with the Direct Express payment network and government cards issued through GSA SmartPay.

Is Apple Pay secure?

Apple Pay is generally considered to be secure, thanks to features like touch ID and face ID. The program does store your credit card information on devices like your iPhone or Apple Watch. So, it may be vulnerable if your devices fall into the wrong hands. But people would also need your passcode or biometric login access to actually retrieve this data. Additionally, Apple Pay can notify you on your iPhone or Apple Watch when your credit and debit cards are used. So, you can quickly reach out to credit card companies if you notice any unusual activities.

Does Apple Pay charge a fee?

Apple Pay itself does not charge additional fees for transactions. However, standard fees associated with your linked credit or debit cards still apply, as do usual wireless carrier fees for data usage during transactions.

Image: Envato Elements

The post originally appeared on following source : Source link