Inflation is trending down from its peak of 9.1%. The most recent CPI reading was 5% compared to year-ago levels. February’s increase was 6% (annualized) over January. Lower, but far above the Federal Reserve’s 2% target. The Fed has raised its policy rate 475 basis points (4.75 percentage points) to curb inflation (slow the economy). Construction and housing, the usual victims of monetary policy, have definitely slowed, but consumers and other businesses have been slower to respond.

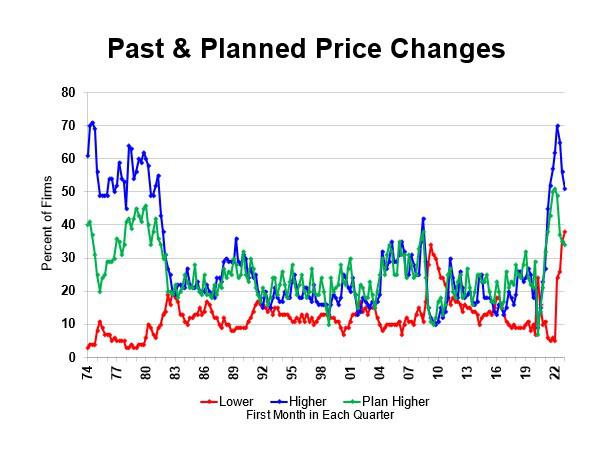

On Main Street, owners have clearly reduced their price raising activity, and the percent planning to raise prices in future months has softened, both good news for the prospect of further reductions in inflation. Reinforcing that is the rising percent reporting that they are cutting prices, not just sticking to the prices they are currently charging. Just stopping inflation will not restore the purchasing power that inflation has destroyed since 2020. Indeed, the Fed’s commitment to 2% inflation ensures a continued decline in the value of a dollar. To get ahead in real terms, income must increase faster than 2%. A period of price reductions (typical in recessions) could restore lost purchasing power, undoing the inflation damage, if widespread enough.

Past and Planned Price Changes

Over the last 49 years, NFIB survey data have anticipated the path of inflation, underestimating in 1980 and over-predicting in 2022-2023, but correctly anticipating important shifts. The regression analysis in Chart 2 illustrates the prediction of the NFIB survey in the first month of a quarter for the inflation that occurs in the entire quarter (announced weeks after the end of the quarter). Currently, the inflation trend is anticipated to slow down.

NFIB Predicted vs Actual Inflation

Most economy watchers see the economy weakening toward the year end. Weaker spending will reduce the incentive and opportunity to raise prices, slowing the pace of price increases and the inflation rate. A significant slowdown will result in widespread price reductions, not just stabilization of prices at current levels. Deflation would begin to restore the lost purchasing power that resulted from rising prices. In some sectors where supply is artificially restricted (energy regulations, bird flu for eggs etc.) prices will be less responsive to reductions in demand overall, so the intensity of price reductions will vary by industry. Policies that increase supply (e.g., more oil and gas) will lower prices. If inflation measures continue to weaken, the Fed is likely to pause to assess the cumulative impact of its policies. Because a large portion of GDP is sold on Main Street, the NFIB monthly indicators will provide clear signals of the direction of inflation.

The post originally appeared on following source : Source link