The recent collapse of a few banks in California sent a ripple of concern through the small business sector. There are about 6 million employer firms in the U.S. Nearly half of all workers (43%) are employed by firms that have fewer than 100 employees (BLS Table F). Only about 20,000 have more than 500 employees, the SBA’s dividing line for large and small employer businesses. In addition, there are several million one-person firms that have no employees. All of these businesses need and use banking services.

In 1983 there were 14,469 independent banks to serve these firms. Today there are only 4,136. The number of branches available has declined as well, from a peak of 85,834 in 2009 to 71,190 in 2022 (FDIC). The banking industry has become much more concentrated. Consider an extreme case, one bank has merged all other banks into one. There are lots of branches. You apply for a loan and are turned down. What is your alternative? Every bank is the same bank; your rejection is on file at every branch. There is no competition to enforce critical evaluations of your application, just a “one and done” deal. Less than 50 years ago, there were over 14,000 independent banks competing for your business. Increasing concentration in financial markets is not conducive to innovation or market pricing (competition) for the loan risks that banks undertake.

Fifty years ago, NFIB surveyed its member firms about the cost of and satisfaction with bank services. In those days, branching regulations were just starting to change. Some states allowed state-wide branching, some allowed a more restricted branching geography and some only allowed a bank to have just one place of business. Owners were most satisfied and reported better terms in the unit banking states, with those in state-wide branching states least happy. There was more competition when each bank building was a separate business, not a branch of some larger firm. The internet has helped smaller banks remain competitive, but concentration continues, all the banks that went under recently were gobbled up by the largest, converting all their branches to branches of the acquirer.

Small business owners still favor smaller banks. NFIB’s August Banking Survey found that 64% of small business owners use a small or regional bank. Eighteen percent use a large bank (Chase, Citi, Bank of America, Wells Fargo, Capital One, U.S. Bank, etc.) and 16% use a medium bank (PNC, Fifth-Third, Bank of the West, KeyBank, HSCB, Schwab, etc.). Forty-two percent of small business owners (or someone from their business) visit their bank more than once per week. Another 35% visit several times a month. Only 8% reported using the internet or phone to contact their banker.

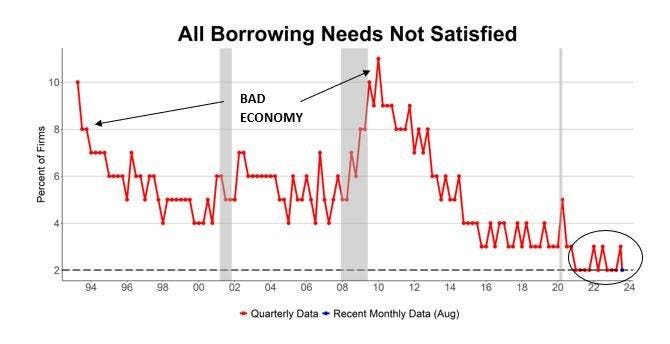

Looking at the last 30 years of NFIB surveys, there have been several periods in which small firms had issues with their banks (Chart 1). In the late 1970s, inflation became a serious problem which the Federal Reserve addressed in the early 1980s by raising interest rates to record high levels. In the 2008 financial crisis (housing), banks tightened lending standards hoping to reduce the risk of bad debts as the Fed cut interest rates to stimulate the economy. Most recently, the percent of owners reporting that their credit needs were not satisfied was at a 30-year record low level, good news for small firms.

All Borrowing Needs Not Satisfied, NFIB Small Business Economic Trends survey.

Although banks are not major financers of new venture business starts, they are crucial providers of financial support to growing firms and continue to play an important role in their development. A third reported the main purpose of their most recent loan was to meet operating and inventory expenses, 26% reported to replace capital assets or make repairs, 20% reported to expand their business, and 5% reported that the main purpose was to refinance or pay down debt.

A healthy banking system is critical to a functioning small business economy. Small business owners rely on them for their most important financial transaction. Banking consolidation puts small businesses at higher risk of not being able to access the funding they need to operate and grow their business.

The post originally appeared on following source : Source link